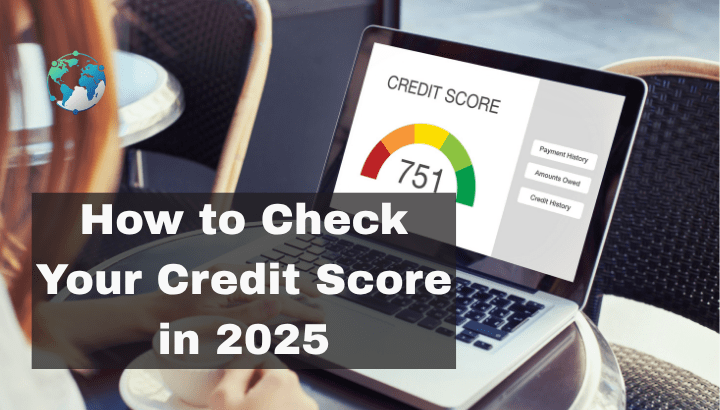

How to Check Your Credit Score in 2025

Your credit score is very important for your financial health. Whether you are applying for a loan, getting a credit card, or renting a home, your credit score matters a lot. But many people wonder, how can you check your credit card for free? Is it safe to do that? Where can you check it? … Read more